submit income tax malaysia

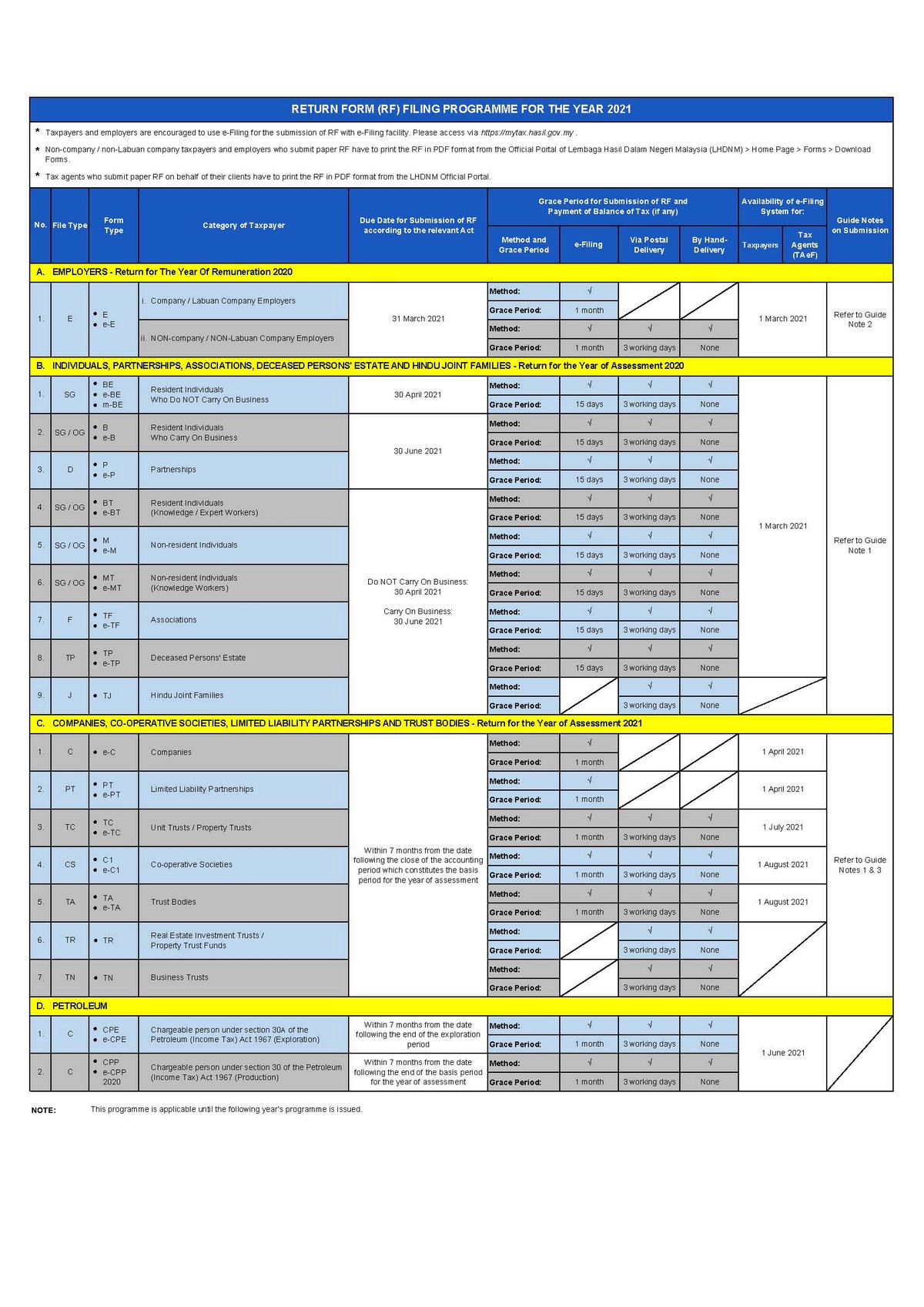

The submission of Return Form RF for Year Assessment 2021 via e-Filing for Forms E BE B M BT MT P TF and TP Forms commences on March 1st 2022. The tax submission deadline under ITA is usually within 7 months after the end of accounting period.

How To Step By Step Income Tax E Filing Guide Imoney

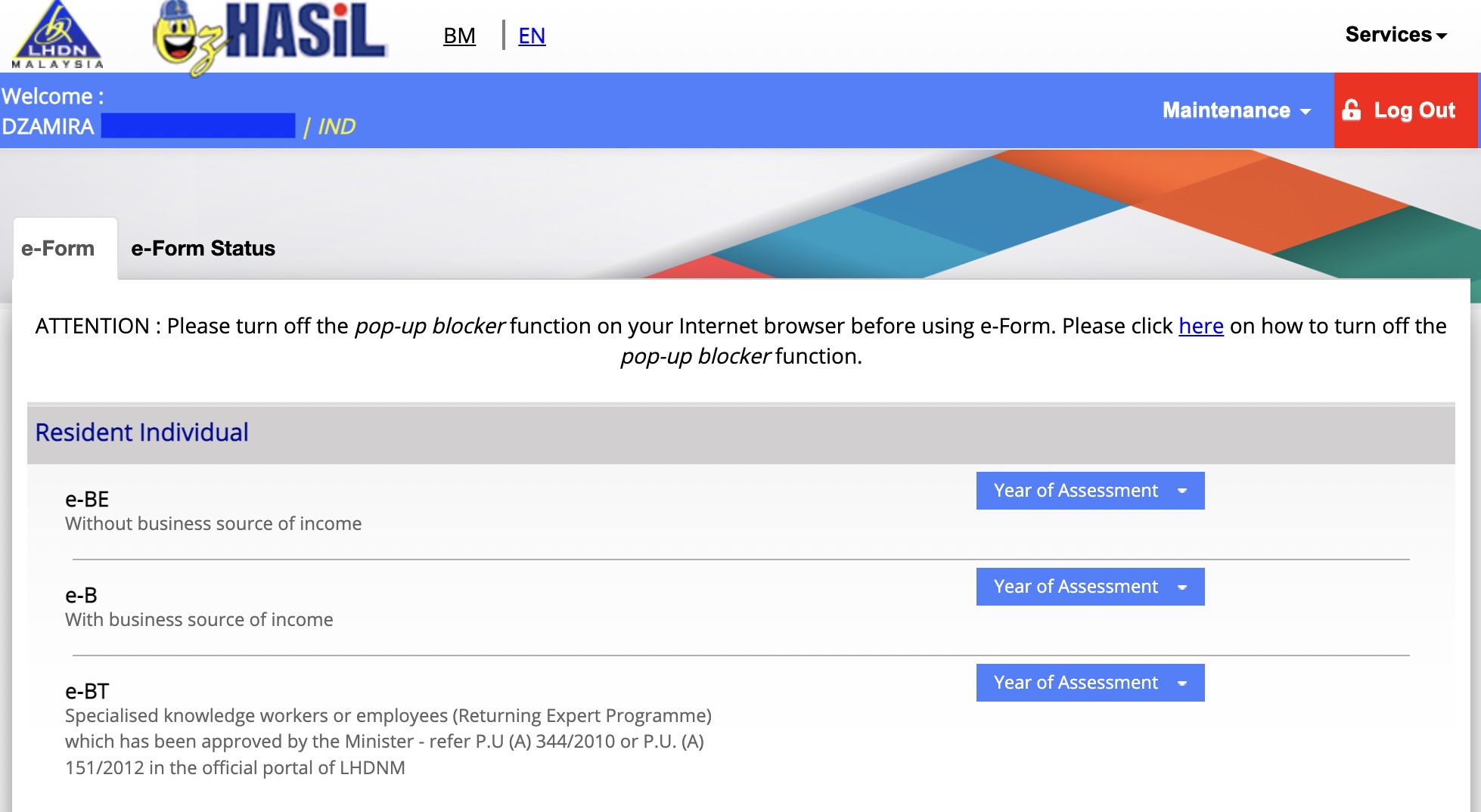

What Is Local Income Tax Types States With Local Income Tax More Yes you should submit your e-filing via the LHDN website.

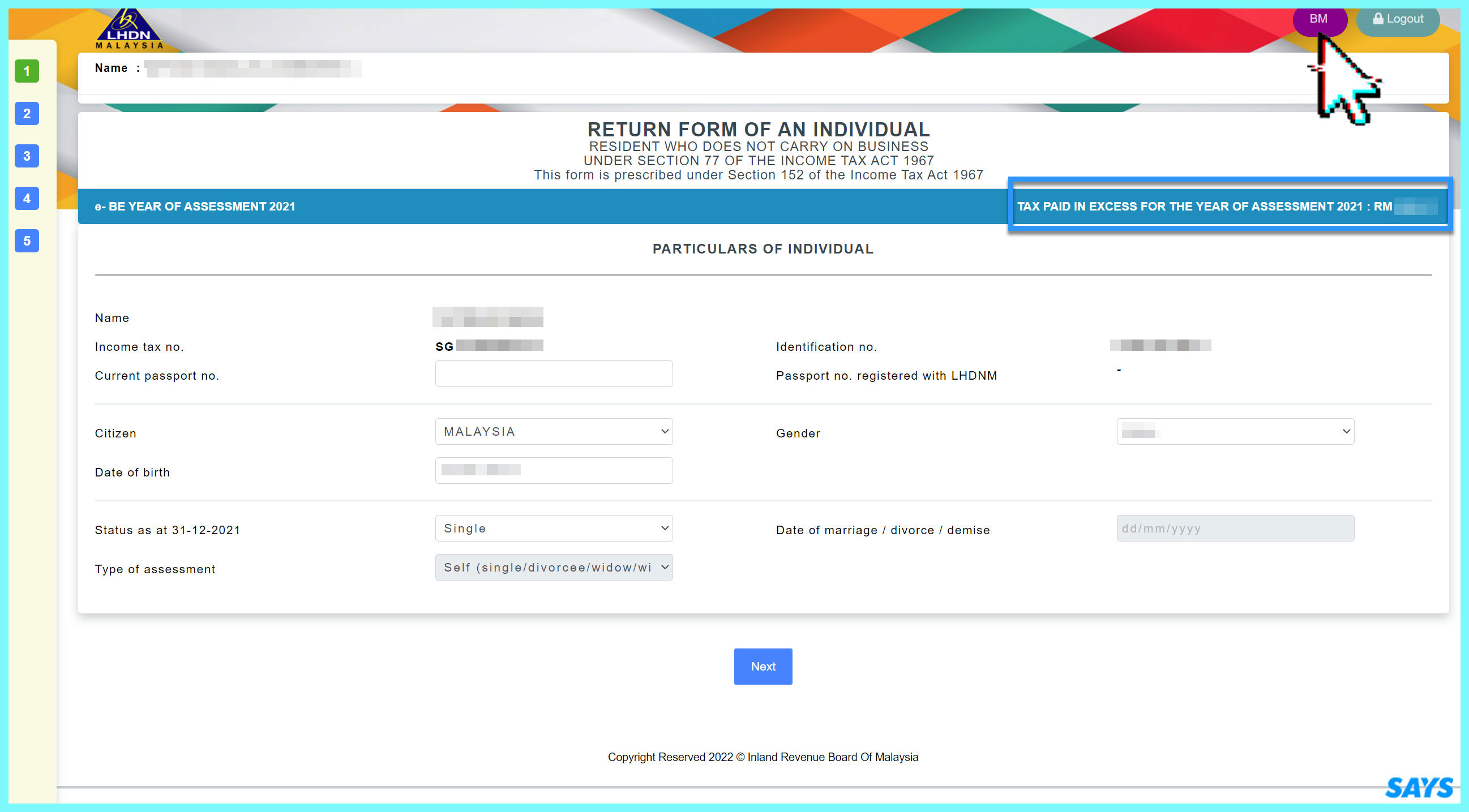

. After reviewing your details click Teruskan under Summary. Before you can file your taxes online there are two things that you will need. If you already have a tax file skip this part.

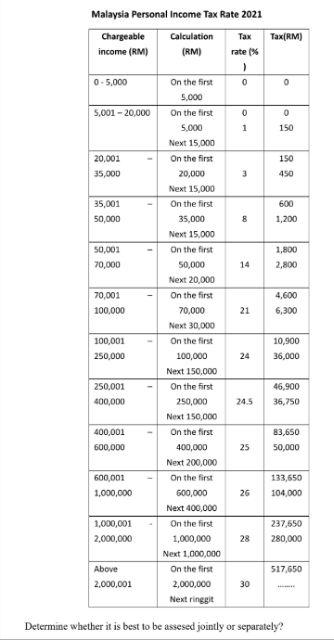

Return Forms can be submitted by two 2 methods. However with this extension taxpayers have a total of 10 months to submit. Given the tax rates above you need to remit RM3750 at a rate of 13.

Ibu Pejabat Lembaga Hasil Dalam Negeri. If you have not attached the required documents such a copy. Manually to Tax Information Record Management Division LHDNM.

If this is your first time filing your taxes online there are two things that you must have before you can start. If you have never filed your taxes before on e-Filing income tax Malaysia 2022 go to httpsedaftarhasilgovmy and click. But you can declare your employment income as RM 000 in this way you are not required to pay tax to Malaysia LHDN as you will.

Your income tax number and PIN to register for e-Filing the online. First RM50000 RM1800 tax Next RM15000 at 13 tax RM1950. Yes you should submit your e-filing via the LHDN website.

Deadline for Malaysia Income Tax Submission in 2022 for 2021 calendar year 1. Taxpayers can start submitting their income tax 2022 return forms through the e Filing malaysia 2022 system starting from March 1 of every year unless otherwise announced. Beginning year of assessment 2020 a company has to self.

You can get your income tax number by registering as a. Every company is required to determine and submit its estimate tax payable for a year of assessment via Form CP204 not later than 30 days before the beginning of the basis. How to apply to file my income tax online for 2022.

With the help of this article you will get to know exactly what you require. Annual income statement prepared by company to employees for tax submission. The first step is to register a tax file with the Inland Revenue Board IRB.

13 rows A non-resident individual is taxed at a flat rate of 30 on total taxable. Kindly refer guide notes explanatory notes which can be. A copy of your latest salary.

Kindly click on the following link. As of 2018 it is stated that you must pay taxes if your annual income exceeds RM34000 per year. Introduction Individual Income Tax.

This amount is calculated as follows. So yes if you are a freelancer you are subject to income tax and therefore. Solution 08022022 By Stephanie Jordan Blog For resident persons who do not operate a company the new deadline for.

Employers are able to make the necessary payments through pen drives CDs diskettes e-payment facilities or by making manual payments through Forms CP39 or CP39A. How to submit your ITRF. When To Submit Income Tax 2020 Malaysia.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking or. Each year you have to go through the ordeal to file your tax return which can be a tedious task for you. Your income tax number and your PIN.

Individual Life Cycle. Once youve filled in all the necessary details double-check the information and click HantarSubmit. The documents you will need.

Headquarters of Inland Revenue Board Of Malaysia. On this page you can view your income tax relief and the final payable or maybe not tax 4.

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

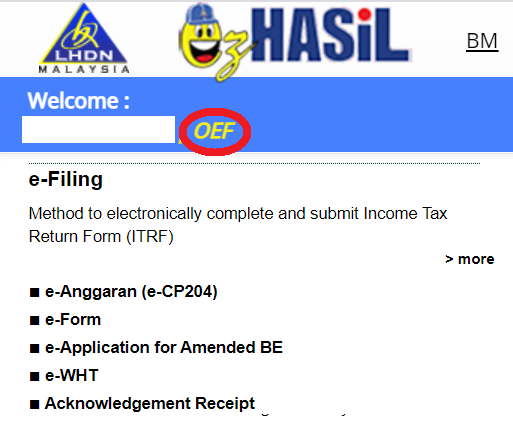

Ezhasil E Filing Login Account Pin Number Digital Certificate Application For Organization The Research Files

Updated 2021 Tax Reliefs For Ya 2020 And How To File Income Tax In Malaysia Using Lhdn E Filing Iproperty Com My

7 Tips To File Malaysian Income Tax For Beginners

How To File Income Tax For The First Time

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

.png)

How To Check Your Income Tax Number

13 Ehsan S Family Wants To Submit Lhdn Return Form Chegg Com

Robotax App Malaysia Personal Income Tax Form Be

Income Tax E Filing Starts On March 1

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Mygov Public Service Delivery And Local Government Eservice Delivery G2c Lhdnm E Filing

E Filing Beginners Guide Income Tax Malaysia 2022 Youtube

Personal Income Tax E Filing For First Timers In Malaysia

Malaysia Personal Income Tax Guide 2021 Ya 2020

E Filing Beginners Guide Income Tax Malaysia 2022 Youtube

How To Submit Your Personal Income Tax Return

Corporate Income Tax In Malaysia Acclime Malaysia

Malaysia Personal Income Tax E Filling Guide 2021 Lhdn

0 Response to "submit income tax malaysia"

Post a Comment